How Much Money Today To Take 350,000 Per Year For 20 Yesrs

What is the Power of Compounding?

Reinvestment of earnings at the aforementioned charge per unit of return to grow the principal amount every twelvemonth is compounding. Compounding is a compelling concept. Information technology is because the interest of your invested money is too earning interest. This is known as compound interest. The value of the investment keeps growing at a geometric rate (always increasing) rather than at an arithmetic rate (straight-line). Reinvestment of earnings at the same chemical compound interest rate of return would assist in continually growing the principal amount year-on-year.

When the principal includes the accumulated involvement of the previous periods and interest is calculated on this and then they say its compound interest. This powerful tool (compound interest) can be used by investors to program their financial goals. In the long term, this technique will benefit the investor. Longer, the investment horizon college are the returns. The correct communication is to get-go saving regularly and invest wisely. An early outset would give the investor a college compounding effect, and building wealth becomes easy. The possibilities of the compound interest are endless. With time, compound interest only farther enhances the earnings, and the investment grows manifold.

Compound interest can exist calculated by:

- Daily compounding

- Monthly compounding

- Quarterly compounding

- One-half-yearly compounding

- Yearly compounding

Compounding is done on loans, deposits and investments. Frequency of compounding is basically the number of times the interest is calculated in a yr. The higher the frequency of compounding, the greater the corporeality of compound interest. The frequency of compounding depends on the musical instrument. A credit card loan is usually compounded monthly and a savings bank account is compounded daily. The frequency of compounding varies based on the scheme offered by the depository financial institution or financial institutions.

One doesn't have to be a financial analyst to understand the concept of compounding. To brand the maximum reward of the compound involvement, invest a small corporeality regularly for long periods of time. Use the compound involvement calculator to see how the magic unfolds with time. Compounding is a technique that makes money piece of work harder. An boilerplate investor depends on this tool to plan for their financial goals. Most long term financial goals become easier and doable because of the power of compounding .

For example, INR 100 is invested, and the compound interest rate is 6% p.a. The chief amount is INR 100, and the interest earned at the terminate of 1 year is INR half dozen (6% of INR 100). Instead of withdrawing the interest amount, it is reinvested, then the principal corporeality for the second twelvemonth becomes INR 106 (INR 100 + INR 6). The interest earned for the 2d year is INR half dozen.36, this is 0.36 more the previous twelvemonth. Fifty-fifty though the amounts look very small, it makes a huge difference in the long term. The magic of compounding works only over long periods of time.

What is the Power of Compounding Calculator?

Compounding is when the returns earned from an investment are reinvested to generate additional earnings over time. In short, compounding is Interest on Interest, hence magnifying the returns over time. The power of compounding uses this concept to estimate the value of an investment.

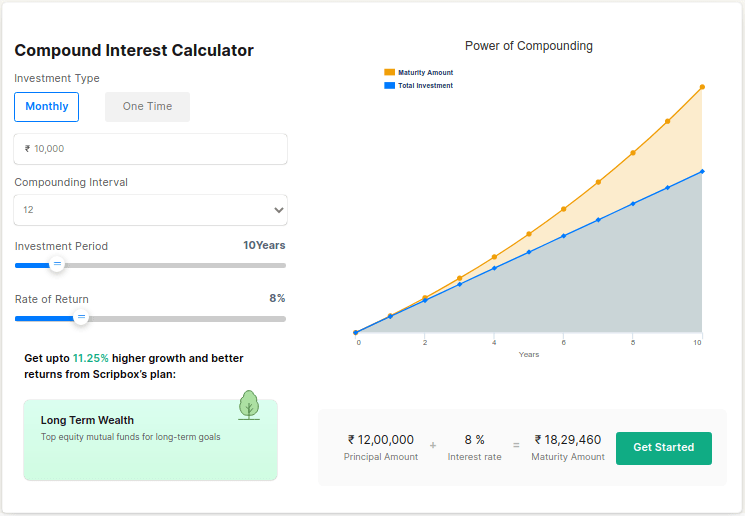

Ability of Compounding calculator is a tool that volition help in calculating the worth of an investment. Information technology calculates the value of an investment subsequently 'n' number of years at a specified involvement rate. The ability of compounding figurer uses compound interest formula equally a basis. The unabridged concept of compound interest revolves around making high returns by calculation the involvement earned to the principal amount at the chemical compound involvement rate. The compound involvement formula used in the power of compounding computer is

P [((one + i)^n) – 1], where P is the principal, I is the annual involvement, and north is the number of periods.

The calculator helps in understanding how much an individual will earn if they invest a stock-still amount for a fixed period at a given annual charge per unit of interest. By using this calculator, i can summate the potential returns from an investment. They can observe out how much their savings will grow if invested.

The calculator has the following components:

- Principal Amount: It is the amount one intends to invest.

- Investment Menstruum: It is the number of years i wants to invest.

- Rate of Render: Information technology is the interest one expects to earn from the investment.

Benefits of using a Power of Compounding Reckoner

The power of compounding calculator is a handy tool. Information technology has the following benefits.

Piece of cake to apply

The calculator is very easy to utilize. All one has to do is enter the three values. The investment amount, investment period (in years), and expected return (in %). The calculator returns the values of full investment, wealth gained, and maturity value along with a graph.

Makes calculation easy and time-saving

Computing compound interest on an investment and determining the final value manually is a time taking process. The power of compounding reckoner gives dorsum accurate results in a matter of seconds. Hence saves time for the investor.

Future planning

The power of compounding estimator helps programme the hereafter financially. Investors can use the reckoner to find out how much an investment volition reap before investing in it. This way, they can compare all the plans and selection the virtually assisting choice.

Free to employ

The estimator is online and can be used multiple times for gratis. Helping investors to plan their futurity toll-finer.

Compare multiple scenarios

An investor tin can use the calculator to run multiple scenarios by tweaking the interest rate, investment amount, and the fourth dimension of investment. He/she tin can compare the results from all the scenarios and discover out the best plan to invest.

How to use the Ability of Compounding Estimator?

The ability of compounding reckoner is effortless to use. It has a master amount, investment menstruum, and charge per unit of return fields. These fields have to be entered past the investor to check how much they will earn. The compound interest calculator gives the total investment, wealth gained, and maturity value both in number and in graphical format. In curt, the power of compounding reckoner shows the maturity value of a lump sum investment at the end of a specified menstruation at a specific charge per unit of render.

Here's an example of an investment of INR 1,00,000 for ten years with an expected return charge per unit of 12%. The inputs to be entered are:

- Principal Amount: In the principal amount field, enter INR 100,000.

- Investment Catamenia: In the investment period field, enter 10 years.

- Charge per unit of Return: In the rate of render field, enter 12%.

The calculator then returns the post-obit values forth with a graphical representation:

- Total Investment: INR 100,000

- Wealth Gained: INR 210,585

- Maturity Value: INR 310,585

The investor can as well see which funds will assistance him/her earn the render they are expecting in a specific period by clicking "Go Started." It will show various investment portfolio suggestions based on investor requirements.

What is Compounding Interest?

The compound interest offers interest on the previously earned interest, unlike simple interest, which earns interest only on the principal amount. But put, compound interest means Involvement on Involvement. The entire concept of compound interest revolves around making high returns by adding the interest earned to the main amount at the chemical compound involvement rate.

Every bit an investor, never withdraw these earnings. Information technology is crucial to have the earning generated to be reinvested to earn college returns. The reinvestment is done at the same compound interest rate of return. Withdrawing the profits wouldn't aid in investment growth.

The compound interest formula used in the compound interest calculator is

A = P(1+r/n)^(nt)

A = the futurity value of the investment

P = the main investment amount

r = the compound interest charge per unit

due north = the number of times that interest is compounded per period

t = the number of periods the money is invested for

For example, Mr. Hari invests INR five,00,000 for x years at a rate of 10% p.a. At the terminate of 10 years, Mr. Hari would have INR 12,96,871 when the investment is compounded. In instance of a simple involvement return, Mr. Hari would earn only INR 10,00,000 at the finish of x years.

The same can exist calculated using online compound interest calculators, which make the calculation seem effortless. Compound Involvement is the foundational concept for both edifice wealth and quick repayment of debt. The compound involvement calculator will aid in getting an estimation of how much an investment volition yield. Scripbox's online compound interest reckoner is customizable. Investors can change the inputs as they wish and examination multiple investment scenarios to choose between the best possible outcome. The scope of compound interest is enormous. Using the chemical compound interest calculator, observe the returns for an investment made at a 6% compound involvement rate. The value of the investment doubles in 12 years, and the same will grow fourfold in 24 years. Initially, the returns might seem low, but with fourth dimension, the returns are enormous.

How to calculate compound interest?

The formula used in the compound interest reckoner is A = P(1+r/northward)(nt)

A = the future value of the investment

P = the principal investment corporeality

r = the chemical compound interest rate

north = the number of times that interest is compounded per menstruum

t = the number of periods the money is invested for

A simple instance, INR 100 is invested, and the compound interest rate is 6% p.a. The main amount is INR 100, and the interest earned at the stop of 1 yr is INR half-dozen (6% of INR 100). Instead of withdrawing the interest amount, it is reinvested, and so the principal amount for the 2d year becomes INR 106 (INR 100 + INR 6). The interest earned for the second year is INR vi.36, this is 0.36 more than the previous year.

Scripbox's online compound interest calculator is customizable. Investors can change the inputs as they wish and test multiple investment scenarios.

How the Power of Compounding works in Investments?

When an investor invests a certain amount, the interest earned on this amount is added to the principal. Then new interest is earned on the new main corporeality. In simple terms, chemical compound interest makes interest on involvement.

Considering the to a higher place example, where Mr. Hari invests a lump sum of INR 5,00,000 for a period of x years at a 10% charge per unit of return.

Beneath is the tabulated data of involvement earned during the investment tenure of Mr. Hari. In Scenario 1, the interest earned is reinvested while in Scenario two, involvement is withdrawn every year.

| Scenario ane | Scenario 2 | |||

| Twelvemonth | Principal Amount | Year | Main Amount | Interest |

| 1 | Rs 500,000 | 1 | Rs 500,000 | Rs 50,000 |

| ii | Rs 550,000 | two | Rs 500,000 | Rs fifty,000 |

| three | Rs 605,000 | 3 | Rs 500,000 | Rs 50,000 |

| 4 | Rs 665,500 | 4 | Rs 500,000 | Rs fifty,000 |

| five | Rs 732,050 | 5 | Rs 500,000 | Rs fifty,000 |

| six | Rs 805,255 | six | Rs 500,000 | Rs 50,000 |

| 7 | Rs 885,781 | 7 | Rs 500,000 | Rs 50,000 |

| 8 | Rs 974,359 | 8 | Rs 500,000 | Rs l,000 |

| ix | Rs 1,071,794 | 9 | Rs 500,000 | Rs 50,000 |

| ten | Rs i,178,974 | 10 | Rs 500,000 | Rs l,000 |

In Scenario i, the full involvement earned is INR seven,96,871, and the total value of the investment at the end of 10 years is INR 1,296,871.

In Scenario 2, the full interest earned is INR 5,00,000, and the total value of the investment at the end of 10 years is INR 1,000,000.

Here the maturity corporeality in scenario ane is higher because the interest is being reinvested, and every twelvemonth interest is calculated on the new principal amount. In other words interest is calculated using chemical compound interest. This little reinvestment of the involvement is helping Mr. Hari to earn nearly INR ii.96 lakhs more when compared to taking out the interest earned every year. This example shows the power of compound interest.

The longer the investment elapsing, the college are the returns. The sooner ane starts investing, the more money starts working overtime, and the sooner it'll help in achieving fiscal freedom.

Therefore, as a wise investor, it is essential to leverage the power of compound interest and start investing early and regularly.

Existence patient during the investment duration is equally essential as investing regularly. The power of compounding lies in the fact that it fundamentally increases the principal amount every year. This increment in principal amount is attributed to the interest corporeality existence reinvested. Chemical compound interest has the potential to earn higher returns and has a definite border over simple interest.

Fundamental Rules of Investment that enable Ability of Compounding

Commencement Immature: Starting investments early will assistance in making the most of the power of compounding. Early investing will aid in building wealth to attain long term goals. Information technology enables funds to abound over time.

Brand disciplined investments: Financial bailiwick is essential. Define goals and work towards achieving them by investing regularly. Small investor or a big investor, information technology doesn't matter, investing periodically and staying invested for long will help in reaping maximum benefits. Below is an instance of how disciplined investments volition help in earning more than money.

Be Patient: Investing for the long term is the central. Don't be in a hurry to earn a quick render. Long term investments reap higher returns due to the power of compounding. E'er give a reasonable amount of fourth dimension for investments to grow significantly.

Scout your spending: Saving is easier said than done. However, watchful spending volition help in saving at to the lowest degree a pocket-size amount. Investing doesn't necessarily have to be only in big sums. Offset with small amounts, and as the income increases, make sure to increase savings proportionately. It will help in achieving financial goals comfortably.

Consider interest rates: While choosing whatsoever investment return is very important. Similarly, a higher annual compound interest rate implies college returns.

Compounding Intervals: The frequency of compounding and wealth accumulation are directly related. The higher the frequency of compounding, more than the accumulation of wealth. Let's wait at the growth of INR 10,000 at 10% compound interest compounded at different frequencies.

| Fourth dimension | Annual | Quarterly | Monthly |

| one | Rs xi,000.00 | Rs 11,038.xiii | Rs 11,047.13 |

| 5 | Rs 16,105.10 | Rs 16,386.16 | Rs xvi,453.09 |

| ten | Rs 25,937.42 | Rs 26,850.64 | Rs 27,070.41 |

It is very clear from the above example that the higher the compounding interval, the college is the wealth accumulated. Also, longer the investment tenure higher is the wealth accumulated.

Top-upwards Investments: Below is the same case of Mr. Hari investing INR 5,00,000 for x years at a x% rate of render. He also tops up his investment every yr by ten%. The table shows how this top-up would assist in compounding render.

| Year | Opening Rest | Investment | ten% Interest | Endmost Amount |

| 1 | Rs 0 | Rs 500,000 | Rs fifty,000.0 | Rs 550,000.0 |

| 2 | Rs 550,000.0 | Rs 600,000.0 | Rs 60,000.0 | Rs 660,000.0 |

| 3 | Rs 660,000.0 | Rs 720,000.0 | Rs 72,000.0 | Rs 792,000.0 |

| 4 | Rs 792,000.0 | Rs 864,000.0 | Rs 86,400.0 | Rs 950,400.0 |

| five | Rs 950,400.0 | Rs ane,036,800.0 | Rs 103,680.0 | Rs ane,140,480.0 |

| 6 | Rs 1,140,480.0 | Rs 1,244,160.0 | Rs 124,416.0 | Rs 1,368,576.0 |

| 7 | Rs 1,368,576.0 | Rs 1,492,992.0 | Rs 149,299.ii | Rs i,642,291.2 |

| 8 | Rs i,642,291.2 | Rs 1,791,590.four | Rs 179,159.0 | Rs 1,970,749.4 |

| 9 | Rs one,970,749.four | Rs 2,149,908.v | Rs 214,990.viii | Rs 2,364,899.3 |

| 10 | Rs ii,364,899.3 | Rs 2,579,890.two | Rs 257,989.0 | Rs 2,837,879.ii |

The full investment fabricated by Hari is INR 25.79 lakhs

Total interest earned is INR 12.97 lakhs

Overall Earnings at the end of 10 years is INR 38.77 lakhs

Benefits from compound interest are highly effective past topping upward investments at regular intervals.

Therefore, to earn college returns, always consider topping up investments at least annually, and stay invested for longer durations. This disciplined habit will not only help in regular savings only is also highly rewarding by earning higher returns. The advice for all investors is that get-go investing early on in life to savor maximum benefits past staying invested for longer durations. Watchful spending and increasing investment corpus every year will too help in edifice wealth faster.

What is the Ability of Compounding in Mutual Funds?

When an investment earns interest on interest, it is called compounding, which all-time works in the long term. Staying invested for longer tenures volition assist investors earn higher. Allow's accept an example of two friends Aansh and Ved. Aansh started investing INR 2,000 per month in equity mutual funds at the age of 21, and Ved started investing INR x,000 per calendar month in equity common funds at the historic period of 35. Both of them kept investing until the age of 50. If both of them earn an interest of 12% per annum, who would be richer? Aansh, of course!

At the historic period of 50, Aansh'south investment value is INR 61.81 lakhs, whereas Ved's investment value would've been INR 49.96 lakhs. Aansh would still be richer if he and Ved invested quarterly or 1-time.

Let'southward assume Aansh invests INR ii,000 every quarter from the historic period of 21 and keeps investing until he turns 50. And Ved invests INR x,000 every quarter from the age of 35 and keeps investing until he turns 50. The maturity value for Aansh and Ved will be INR 19.89 lakhs and INR sixteen.31 lakhs, respectively, if their return is 12% per annum.

If Aansh fabricated a lump sum investment at the age of 21 of INR 25,000 and Ved fabricated a lump sum investment of INR ane,00,000 at the age of 35, both at a return of 12%. Their maturity value when they turn 50 volition exist INR 6.68 lakhs (Aansh) and INR 5.47 lakhs (Ved).

| Aansh | Ved | |||||

| Frequency of Investment | Tenure of Investment | Investment | Maturity Value | Tenure of Investment | Investment | Maturity Value |

| Monthly | 29 Years | Rs 2000 | Rs 61.81 Lakhs | 15 Years | Rs x,000 | Rs 49.96 Lakhs |

| Quarterly | 29 Years | Rs 2000 | Rs nineteen.89 Lakhs | 15 Years | Rs 10,000 | Rs 16.31 Lakhs |

| One Time | 29 Years | Rs 25,000 | Rs 6.68 Lakhs | 15 Years | Rs 100,000 | Rs five.47 Lakhs |

Fifty-fifty though Aansh's investment was less than Ved, the duration of his investment is longer. And compounding best works in long investment tenures. Hence, Aansh's maturity value is college than that of Ved's.

The longer one stays invested, the more than will be the money they make. To take advantage of the do good of compounding, one has to remain invested for long tenures, which can be washed by investing early on.

What are the benefits and advantages of compound involvement?

Compounding helps investors earn interest on involvement. The following are the advantages of chemical compound interest.

- Compound interest makes investor's coin grow faster as it helps earn interest on interest.

- Longer, the investment duration more will be the potential to earn higher returns.

- Make regular contributions to the existing investment to add together potential to compounding.

- The higher the number of compounding periods, the higher will exist the returns. Compounding every month can earn more than than compounding annually.

Oft Asked Questions

What is the magic of Compounding?

The magic of compounding is that the involvement of investment as well earns involvement. Information technology is non the instance with simple interest. In simple interest, the principal amount remains the aforementioned, and interest is withdrawn. In case of compound interest, the main amount keeps growing every year as the involvement earned on the initial principal is added to the principal to become a new chief amount. This new principal then earns involvement the next year, which is added to the principal again. Hence the compound involvement will assist investors brand more than money. Information technology is the magic of compounding.

What does compounding involvement hateful?

Compounding interest is calculated on the initial principal and all the accumulated interests of previous periods. Information technology is calculated using a unproblematic formula where the principal amount is multiplied with i plus the interest raised to the power of the number of compounding periods minus one. Beneath is the chemical compound interest formula. P [(1 + i)northward – 1], where P is the principal, I is the annual interest, and n is the number of periods.

Is it amend to compound monthly or daily?

The number of compounding periods makes a significant deviation while calculating chemical compound involvement. The higher the number of compounding periods, the greater the amount of compound involvement. Compound interest has the ability to heave investment returns over the long term significantly.

Tin compound interest make you rich?

Compounding has the power to earn more than money in the long term. It is considering the interest earned on initial investment besides makes interest. Compounding creates a snowball effect wherein the initial investment plus the involvement on it earns involvement and hence grows together.

What do you hateful by compounding?

Compounding is the process where the returns earned from an investment are reinvested to generate additional earnings over time. In short, compounding is Interest on Involvement, hence magnifying the returns over time.

Who benefits from compound interest?

Investors can do good from compound interest if they stay invested for longer durations. In compounding the money grows at a faster rate than simple involvement.

Source: https://scripbox.com/plan/power-of-compounding/

Posted by: davisanney1978.blogspot.com

0 Response to "How Much Money Today To Take 350,000 Per Year For 20 Yesrs"

Post a Comment